Spring Lift in North Shore Real Estate Market

So, what’s happening in our real estate market? Real Estate agents have to be positive – it’s our job! I don’t know anyone who would employ a real estate agent who wasn’t positive and enthusiastic! So here’s a little reality..

On the North Shore the real estate market in winter has been quite difficult and patchy – May and July were horrible, June was excellent, and I sold 4 homes in August! But winter is always a bit like that, it’s been wet, wet and wetter, and the post budget blues didn’t help either. But what’s happening right now?

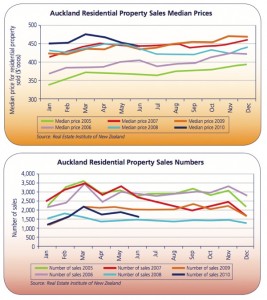

Well I have been checking our year to date sales and, like Barfoot and Thompson, we can see that 2010 is a much better year than 2009, by 20%. Thats right, at least 20% better than last year. Sales Volume is up 20% and values up 24%. Take a look at the REINZ graph above and see what Olly Newland has to say here. Quotable Values, usually a little bearish, report that sales are up 5-6% on an annual basis. I have included their report at the end of this blog.

So what! Well…. if you are thinking of buying, then maybe you should. And if you are thinking of selling, then maybe you should…

Buyers

There have been those in the New Zealand Herald telling buyers to be cautious. Well gee whiz! so buyers should be..in any market. Always good advice! Have a good look around, get a building inspection, make sure you follow the golden rules; location, location, location, and buy the worst house in the best street and then buy the house you like. Make sure you get a good mortgage and pay it off.

This is a good time to buy, interest rates are low, but they are not likely to go lower. Delay a year and you can guarantee that rates will be higher. Right now mortgages are more affordable than they have been for years.

Don’t get caught in the rent trap. It might seem cheaper in the short term, and the likes of Bernard Hickey will tell you it makes more sense to rent than buy, but be careful…you can pay rent all your life and you’ll never even own the letterbox. And if you got off the property ladder during that downturn in 2009, make sure you get back on now….it can be very hard to get back into the market once you are out. Any improvements you make to a house while you are renting is money down the drain, and the landlord can just send you a pink slip and have you out of there at very short notice. If you rent, it is not yours. If you own, it is your own home.

And rents are rising, GST goes up in October, rates will rise too, and now that the government has changed the depreciation allowances we can expect more rises. Again, we are noticing rents are rising – around $20.00 per week and more in our office. Good news!…. if you are thinking of investing in a rental property! (I have bought a block of 3 flats this year and looking to buy another soon). Bad news if you decide not to buy and continue renting.

As Olly Newland says: “Take your courage in both hands so that in the future you will not look back and say “If only I had taken advantage of the market during the recession in 2009/10 instead of hesitating!”

Sellers

Right now the spring lift is happening. Open homes I ran during August had 100′s of people attending. Two homes I sold were on the market less than 30 days. At 78a Castor Bay Road one weekend I saw 75 people, many were cashed up buyers who had gotten out of the housing market in 2008/9 or were immigrants or returning expats. Some of these immigrants have been here for a few years and while their pounds and US dollars are not as good as they once were, the value of their currency is not improving, and they can see now is the time to buy. Many had pre-approved mortgages. Mortgage brokers report that enquiry is strong and that the banks are ready to loan. For example, some banks have reduced the deposit required for a home loan from 20% to 10%. You can expect buyers in the market this spring.

Many sellers will wait to see what happens next and there could be a flush of property on the market in November. Meaning there will be lots of competing properties on the market. My advice? If you are thinking of selling in the next 3/6 months, NOW is good. Here’s 12 ideas on how to sell your North Shore house in spring. Christmas is only 100 days away. That is not a lot of time. Get your copy of the 7 Secrets of Getting a Great Price for Your Home when You Sell NOW and then me a call on 0800 61 8888.

I have a particular shortage of family homes with lawns and garden for children and dogs, with space for 3 vehicles or more, in all areas. If you have a 50′s, 60′s or 70′s home give me a call now (Radio Hauraki has some great rock from this era!….great music and great homes go hand in hand, do you think?)

Here are my sources:

Olly Newland has a great blog on the housing market on his website called “Have We Turned the Corner”

and interest.co.nz has a superb overview of the current market here, including the following article by Glenda Whitehead at Quotable Values:

Auckland Market Report

QV’s Residential Price Index for August shows that property values in the Auckland region are just beginning to stabilise, although have dropped by 0.7% since March this year. In contrast, values increased by 6.7% in the 7 months to March. Consequently, values now sit 5.9% above the same time last year, but 2.4% below the market peak of late 2007.

Glenda Whitehead of QV Valuations said; “Values in the Auckland region’s residential market now appear to levelling, although it is too soon to tell whether this is the end of the downward trend which has persevered since March”.

“August activity remained light and caution prevails, but we are seeing early signs that home owners are gearing up to make decisions. We suspect many are assessing their options and actively seeking information, as we have noticed a recent in increase in Market Valuation reports by QV’s registered valuers”

Ms. Whitehead said. “Some home owners are taking advantage of readily available builders, planning extensions and alterations to their existing homes. While this data is not fed into the QV index, it is a sign that home owners view the property market positively enough to believe the cost of renovations will be recouped in the future. Cost and added-value differ, but those we speak to are making long-term decisions whilst enjoying a higher quality home in the short-term. This activity is obviously only being undertaken by those in secure employment and with good levels of equity in their homes” Ms. Whitehead said.

“The North Shore market remains patchy, with no push from buyers. The time taken to sell a property remains extended, with agents reporting low activity levels. However, we believe pre-approvals and requests for refinance are on the rise, a possible signal of a pending bounce in the spring market” Ms. Whitehead said.

“Auckland City is characterised by general lack of confidence. Higher quality properties are still faring reasonably well and some good prices are still being achieved when the right buyer finds the right property. Buyers appear more demanding of quality, and are overlooking properties that have any negatives” Ms. Whitehead said.

“Activity in West Auckland remains subdued and buyers remain cautious, as in other parts of the region. Many home owners are refinancing their existing situation. Of the homes that are selling, those that are upgraded and well located tend to be the ones that find a buyer” Ms. Whitehead said.

“Activity in the South and South East market also remains subdued. Values do however appear to be relatively steady with fewer listings and fewer sales. The lower end of the market, sub $300,000, now appears to have become more attractive to investors, reflecting improved yields. But again, buyers remain cautious. Anecdotally, activity in the $400-600k bracket seems limited.

Uncertain economic conditions continue to dampen confidence” Ms. Whitehead said. QV’s Residential Price Index is calculated using sales data from the 3 months leading up to the month being reported. It is not the same as the average sales price, which fluctuates in line with the mix of properties selling in upper or lower price brackets. The average sales price for the Auckland region in July was $535,918.

7 Secrets of getting a great price when you sell your home…

7 Secrets of getting a great price when you sell your home… Home Energy Ratings

Home Energy Ratings

4 comments

Tony,

Is this this year’s budget?

Blog posts should be short and the graphs aren’t readable.

Good effort otherwise.

Arel

Still lots of speculation and trying to upbeat a stink market for sellers. We had one offer in 3 months that was 60k below GV! Thats an insult especially when you have seas views, 5 min walk to beach, big section and privacy. If you can show me a house near Castor Bay that doesn’t need any work and has a granny flat (in excellent state) Im interested.

Paul

Hey Paul have you seen 122 Beach Road yet? This is a home and income, immaculate, very nice living areas and kitchen and only 5 mins walk to Castor Bay beach, Kennedy Park, and not so far from Campbells Bay beach. Here’s a link: http://www.harcourts.co.nz/Property/View/TK4348/Castor-Bay-122-Beach-Road

Ariel

These figures are current end July, 2010. Source material is Barfoot and Thomson, Quotable Values, Olly Newland. Probably is a bit long sorry!

Leave a Comment